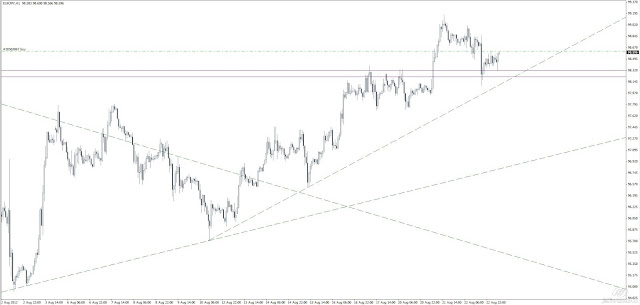

EURUSD

Seeing as its NFP's tonight I will sit the rest of the week out. Its been quite a quiet week for me but thats usually expected seeing as its the 1st week of the month and also the month of August which has a reputation for being a little bit erratic.

I just wanted to post this chart of EUR and how technical it has been. I dont like trading during big news announcements like the ECB or FOMC or any other acronym that seems to cause huge reactions in the markets as I tend to find you get stopped from whipsaw more than anything else but had the big boys not been out and about talking their talk these levels would have been very nice to play.

Note how that old support level held to the pip and had a 3rd touch trend line near it. SO CLEAN!

Then there was the support turned resistance turned support again. I love these setups when I can catch them!

Well thats it for me. I hope you all have a great weekend and remember play it safe tonight and dont get into too much trouble if you are gonna play at all!!

J