Saturday 29 September 2012

Taking a break

Have decided to have a break from blogging for various reasons but sometimes it can be a bit much completing my journal as well as a blog as my journal is very detailed with pics and all as Im a visual person.

I wasnt too sure what direction to take the blog when I 1st started so used it for more of a journal so Ive decided 2 journals are a bit too much work. Call me lazy!

There are so many good blogs and sites out there these days on FX Trading but there also are so many bad ones and hacks!

Some of the ones that Ive always liked are:

www.tradingwithdeadlyaccuracy.com

www.forexleechalert.blogspot.com

www.nobrainertrades.com

www.innerfx.com

joetradingplace.wordpress.com

explorefx.tumblr.com/

All the best in your trading!

J

Charts

GBPAUD

Took about 80 pips out of this one as was clearly stalling at a strong resistance level.

This pair has been extremely good to me ;)

NZDUSD

Was looking for low to hold as support. Had target set to close out 1/3 of position at level marked but was 5 pips shy of level before going to sleep. Decided to close out 1/3 and move to BE. Got stopped on remainder of position at BE. I normally dont like fiddling with my orders i.e. closing out early as I think it can sometimes be a bad habit but sometimes as I can cut my profit a bit short sometimes but if price doesnt look good I would rather get out with some pips rather than none.

All in all has been a good week and am holding a couple new positions from Friday into the new month. Am currently sitting on EURGBP long for a long position (lots of room to the upside), NZDUSD short and GBPUSD short. All positions in profit and GBPUSD has had 1/3 scaled. Heres hoping for a good open and new start of month!

J

Tuesday 18 September 2012

Charts

AUDUSD

This is my 1st trade in over a week. There was too much important data last week that I felt if you werent already positioned it wouldnt be worth playing as you could've got done by a news spike plus I couldnt find an entry that meet my rules. Seeing all the volatility and movement was good to see come back into the markets but truly I didnt feel like I was missing out on anything whereas previously I would have been itching to try and catch some of the big moves.

Got stopped on this pair this morning for -60 pips. Entered this trade looking for trend continuation. In hindsight there was a few stronger things playing against me like the level that price formed its high with those wicks is in line with a historical high so I guess a deeper retrace could be expected as there would be plenty of sell orders there from traders that play historical levels. The daily candle from Friday was also a pin so fighting that probably wasnt my best move. Another lesson learnt which Ive always been aware of but I guess sometimes overlook which is look for the bigger level to hold.

J

Friday 7 September 2012

Charts

This is 1 of 3 trades taken in the last couple days. I wanted to post this one 1st and review it as I got stopped out on this trade but there was a great lesson in it for me.

I dont normally fade levels but it is something Im working on. I entered 2 orders on this trade fading the level. The 1st on the high of the box and 2nd on the low. I put my stop overnight way too tight as it was about 5 pips below the bottom of the box I defined. During the day got whipsawed by AUD employment figures and of course if you see where AUD is now you will see that my thinking was correct. This one stopped me out for about 35 pips for both position which Im more than happy to pay for the lesson I learnt.

Lesson learnt: Place stops in a place where price shouldnt go and if it does it completely invalidates my thinking. Of course different methods would have different stop placement but seeing as I was initially looking to build a position and capture a larger move to the upside a super tight stop just doesnt seem smart at all.

GBPAUD

Well I closed out my long where I said I was looking for a short. Because of my 1st trade I was looking for AUD strength, when I saw the H4 bar close and come smashing down I took the trade. Closed out this morning for about 80 pips.

NZDUSD

Seeing as I was bullish on AUD Im definitely going to be bullish on her little sister (Kiwi's hate being known for this but they know its true. I know cause Im married to one). There was this setup thats one of my favs as its so easy to define risk but was also a little cautious as there was a clear trend line there acting as resistance. Was monitoring it all night due to ECB and everything else happening but once she broke it was all good. Set my target at the gap and target was hit by the time I woke up this morning. Nice way to start the day.

All in all solid start to the month and am flat going into the NFP's. Gonna have the night off so hope you all enjoy your weekend and make sure you spend some time outside getting the fresh air not being stuck in front of your charts all weekend.

J

Wednesday 5 September 2012

Charts

Update

Have closed out final position for 800 pips as price is approaching a level I was planning to short from.

This is the longest Ive held any trade for and most amount of pips Ive banked from 1 trade!!!!

GBPAUD

Took this trade last Thurs. Was hunting for the trade on Wed but decided to pass as there was major news on GBP. On Thurs there was another opportunity to take the trade, my entry wasnt the sharpest as price pretty much went against me from where I opened the trade but the reason I was happy to take the trade was my target was well defined.

Have scaled out of this position and will be watching closely to tighten up my stop on the remainder of the trade.

Ideally would like to see a trend line break and price start forming support, if this happens I will be looking to build on a position. See what happens in the coming days.

J

Wednesday 29 August 2012

Charts

GBPUSD

This is just a simple SR play. This is my trend continuation setup. Price acted as res so I marked the zone and once it broke the level when price came back it acted as support.

Have scaled out 1/3 pos and stops are at break. 2nd target will be most recent swing high.

J

Monday 27 August 2012

Charts

EURJPY

So Im a little bit behind today as this was my trade from last week and I was meant to update over the weekend but decided to take it easy on the weekend and finish all loose ends today.

Took this trade as price has been making HH and res turning to support. Missed the 1st entry when price went straight into level (I think there was a FOMC meeting or something) but when we had a bullish bar the next day looked like level was holding and I was looking for continuation. Not much happened and eventually got stopped out on Friday.

Down 40 pips on this one and that was all I did last week.

Last week of the month this week and data looks quite light so will be interesting to see how this week plays out.

J

Wednesday 22 August 2012

Master The Method

Theres many ways to skin a cat and with all the fancy whiz bang indicators these days multiplied by the currencies and different timeframes there are so many different options/styles on how to trade. This is where I believe most people get lost. They hear someone on twitter or a blog post some winning trades and maybe that individual is using a 7, 31 and 79 moving average (I just used numbers from my birthday but hey who knows maybe they are the holy grail....lol) or someone else is using the MACD with different settings and so the aspiring trader thinks this person has the answer or the SECRET. Well the truth really is that the only difference between the successful trader and the unsuccessful one is that the successful one has mastered their method/strategy. The successful trader has defined their edge and know what they are looking for and when it happens they strike. The reality is from my experience all strategies work some of the time and it is your job as the trader to figure out how to make the strategy work most of the time. This may mean sitting doing hours of testing and finding the nuances to the method but in the long run it will be worth it.

Once you understand what defines a high odds setup then just hunt them. This may mean sitting there for days waiting for a setup to form and if you struggle with this its not methods/strategies or setups you need to work on its you PATIENCE! Ive heard WMD aka Will Hunting ask a very valid question which is "Whats the minimum number of trader to take a day?" Think about it for a second and if your answer is greater than 0 this could be where you are getting in trouble. If you trade on timeframes like the M15 or higher I do not believe you can get really high odds setups every day or at least this is the way that I see the charts anyway.

Ive noticed common patterns/setups occur on the chart regularly but they dont occur every day so when the pattern/setup happens then I know what to do and this is what Im hunting.

Remember the key to successful trading is "MASTERING THE TRADE NOT BEING A JACK OF ALL TRADES"

J

Wednesday 15 August 2012

Charts

GBPCHF

Took this trade yesterday once I saw old resistance holding as support. Simple but effective.

Have to admit price was in and out of profit since I took the trade so was unsure how could go but had more confidence in trade once yesterdays candle closed a bullish pin.

Have scaled out and in a risk free trade. I actually have a longer term view on this trade but will need to see how price plays out over the coming days and see if Im still in the trade.

Thursday 9 August 2012

Wednesday 8 August 2012

Charts

Played the trend line break and re test but was stopped out at BE.

Entry wasnt the tightest as an aggressive entry could have been taken when price was about to strike the line but I prefer having candle confirmation and in this scenario I was waiting for a H1 to turn bullish and the candle that confirmed was quite a large candle. Guess thats the way the cookie crumbles.

Friday 3 August 2012

Charts

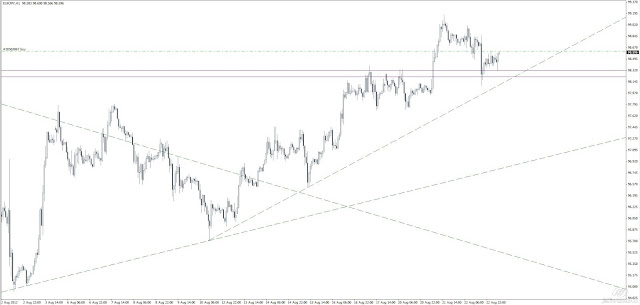

EURUSD

Seeing as its NFP's tonight I will sit the rest of the week out. Its been quite a quiet week for me but thats usually expected seeing as its the 1st week of the month and also the month of August which has a reputation for being a little bit erratic.

I just wanted to post this chart of EUR and how technical it has been. I dont like trading during big news announcements like the ECB or FOMC or any other acronym that seems to cause huge reactions in the markets as I tend to find you get stopped from whipsaw more than anything else but had the big boys not been out and about talking their talk these levels would have been very nice to play.

Note how that old support level held to the pip and had a 3rd touch trend line near it. SO CLEAN!

Then there was the support turned resistance turned support again. I love these setups when I can catch them!

Well thats it for me. I hope you all have a great weekend and remember play it safe tonight and dont get into too much trouble if you are gonna play at all!!

J

Wednesday 1 August 2012

Charts

EURUSD

Im just looking at this pair and thinking everything about it is technically down at the moment.

You can see Ive marked a potential trend line waiting for validation with a 3rd touch which is also aligning with a proven support level so we should be expecting it to turn resistance and this zone could also be an attraction point especially for the 3rd touch of the line BUT...............

If these levels are broken and when I say broken I dont mean by a few pips I mean a strong break through the level there could be a potential move long for a decent move. I think either way some interesting levels that could provide some trading opps. Will need to see what kind of reaction we get from the major news announcements this week either way hopefully we can get some volatility and some direction for some trading opportunities.

Hope you all have a great trading month!

J

Tuesday 31 July 2012

Charts

GBPCHF

1st trade of week. Not really gonna look for anything else today as a new month begins tomorrow.

Would rather wait for the new month to begin and see how the rest of the week wants to play out with lots of major news announcements out this week.

Price was failing to break through 3rd touch of trend line so opened trade on confirmation of line holding on M15. Not much really happened from when I took the trade last night till sometime today but finally we got movement in the direction I was looking for. Ive scaled out 1/3 position and stops at BE so no risk on table. Gonna let the rest ride to my TP2 and TP3 or stopped at BE.

J

Friday 27 July 2012

Charts

EURCAD

Last one for the week. This is one thats been going in and out of profit since I took it. I almost got stopped but she's still going.

I entered off the strike of the yellow line but Ive also marked a trend line and triangle that Ive noticed to support my thinking for a push north.

Price is looking like its establishing support and making new highs. I got my 1st TP set roughy about 1:1 and am gonna see how long I can hold as there is quite a bit of room to the upside if we can break north.

Have a great weekend all!

J

Wednesday 25 July 2012

Charts

GBPAUD

Was looking to start building a position long on this pair. Should have got stopped at break as had 1st position up 100+ pips at one point then added 2nd position and got stopped from news.

Got slipped by the broker on my stop by 30 pips. Should not have taken the 2nd trade leading into major news. Lesson learnt!

J

Charts

USDCAD

Got stopped at break on this. Fell short of my 1st TP by a few pips.

There was a perfect entry on the strike of the line and I would have taken this one but was already in the trade using a different technique for entry.

Am not opposed to taking another entry if it strikes the line again.

J

Monday 23 July 2012

Some fun stuff to start the week

Rich Froning JR recently won the Crossfit Games for the 2nd year in a row. This is just a quick snippet of the Games and how hard these guys really push themselves.

I do Crossfit and it gives me the best workout day in and day out that has effected my life both physically and mentally (which assists with my trading).

J

Charts

GBPUSD

I took a small position on this on Friday. I generally dont like opening new trades on Fridays so this trade was at a reduced position size looking to add today (Monday).

There was a bit of confluence on this trade as price was aligning with old highs and I had the confirmation when my lower trend line was broken.

Since the open price has just fallen so I have scaled out to cover the stop but still have the view to add if I can get a clean technical entry.

Thursday 19 July 2012

Charts

NZDUSD

Continuation trade. All candles are pointing up so really just looking for continuation.

Have scaled and moved stop to break as approaching a strong resistance area on the left so would rather walk away with a few pips than none at all considering markets aint really doing much at moment.

Learning When NOT to Trade.......

We spend so much time trying to identify high odds setups and trades that we sometimes may end up looking for something that just isnt there or see what we want to see and only once you have been stopped out and looked back on the trade and thought "why the hell did I even open a trade there?"

Whilst yes we must develop our skills on when to trade we must also have an eye for when the markets arent doing much for us and sit on our hands, read a book or watch Masterchef (this show makes me hungry).

I posted a chart above where looking at the current price action is of no interest to me as the way Im looking at it its currently in the middle of a range and the odds of it going up are no better than it going down. I dont like these odds so I would rather sit aside than gamble on a trade trying to hope that I can score a few pips.

Its a hard thing to learn in trading to sit on your hands and trust me I still have troubles with this but if you can identify when NOT to trade and then have a clearly defined edge and trade that only when it provides its signals you are on your way to consistency.

Remember something that is very important that I think soooo many people including myself sometimes forget: Trading is not like anything else you have done in your life/career and is not like a job. Dont think because you sit in front of the markets for 5, 6 or 10 hours a day you have to be paid for that effort today.

If you're after a job that pays you an hourly rate go get it but I think you will struggle to get that from trading FX.

J

Wednesday 18 July 2012

Charts

EURUSD

Got stopped at BE on this trade. Came within 3 pips of my 1st TP which is kinda annoying but I guess thats the game.

Entry was based on the line holding. I sometimes will play the strike of a line quite aggressively but seeing as it was Monday I was playing quite cautious and waiting for confirmation from the 1 hour with a decent close. The bar I also entered on was a very large bar which gave me the confirmation and based on my plan my R:R was good but once I saw price get within 3 pips of my T1 and start turning I decided I would rather get stopped at break even than have a loss.

Friday 13 July 2012

Plan For Profit

Plan your trade and trade your plan. A common saying we have all heard. But do you really do it?

Theres 2 parts to this comment:

1st - Plan your trade: I believe the difference between winning and losing traders is a winning trader takes a more professional approach by planning out and really analysing their trades and all possible outcomes whereas the losing trader just pulls the trigger like they have a machine gun and unlimited supply of bullets (Im pretty sure we have all been guilty of that at one time or another). Which if you had an endless supply of bullets (cash) I dont think you would be trading. From my own personal experience I tend to find the less trades I take, the longer time there is between my plan for a trade and execution of the trade the higher my win rate and profit tends to be. Of course there are many different styles of trading and personally I prefer to have a high win ratio and good R:R so obviously these setups dont occur everyday which means I generally have time to plan out a trade but I know of guys that would rather trade more often maybe sacrifice a bit of the R:R and are still very profitable. This is where you have to know you personality and what would suits you better.

2nd - Trade your plan: So often we are so focused on entries that when we nail the entry we dont know what to do. We close the trade out too early because we have been stopped out a couple times this week or we get too greedy and hope this trade is the one that runs for 1000 pips and somewhere along the way we get stopped at break even or worse a loss. This is why we should plan up front before we pull the trigger what our method is going to be on how to manage the trade. I use varying methods depending on the type of trade I take but my most common will be either scaling out 1/2 to cover stop or scaling out 1/3 and in both scenarios I generally let it run unless its a counter trend scalp which I would have a hard fixed target. This also is where the discipline comes in because if you truly have planned out your trade which could be a phenomenal plan but suddenly you get 1 hourly bar close in the direction against you which you didnt expect and you suddenly rush to get out (speaking from experience). So once you have a well laid out plan follow it.

So all in all what Ive just discussed is actually quite basic, nothing new to trading and your probably thinking "Man everyone knows this blah blah blah" but I truly ask you:

Are you a profitable trader and if the answer is no are you doing points 1 and 2 above or are you machine gunning away like Arnorld Schwarzenegger in Commando?

J

Thursday 12 July 2012

Charts

Cable

Heres an entry that I have just taken and have scaled out 1/2 of the original position to cover the stop.

I have been looking for the USD to strengthen all week but as most of you will already know it really has been quite non eventful. I was hunting a couple shorts last night on both NZD and GBP but price fell short of my entry zone only by a handful of pips. I guess thats the game and you gotta be willing to accept that you cant catch them all.

The entry I used above was quite aggressive drilling down to an M5 and the main reason I did that on this occasion is because of how much the USD has been strengthening against all pairs today I was looking for a continuation move and found this break was was good enough for me. I only risked 19 pips on the trade and it never went against me which is nice.

J

Wednesday 11 July 2012

Charts

NZDUSD

This is a follow up on the kiwi trade I took last week. I ended up closing out that position for +74 pips but took about a -27 pip loss when I added to the position so I banked 47 pips.

The 2nd position should never have been added but I think I was a little too eager to trade on Monday and that is what ended up in me sacrificing some of my profit.

I generally dont trade on Mondays or at least before NY but again that need to trade on Monday and seeing as I was already in profit so greed ended up in a reduced profit in the end.

Lesson: No more trading on Monday pre NY.

Saturday 7 July 2012

Charts

NZDUSD

I have been watching this pair for most of the week and been watching the lack of movement in the pair and wondered if the consolidation area had been soaking up buy orders as it was reaching levels where I would be interested in looking for shorting opps. Once I saw price breakout of the consolidation and close straight back in that was my confirmation so I pulled the trigger which was on Thurs night.

Leading into NFP I was in the money but not by much, it was going in and out by 20 or so pips so I decided to close out 2/3 of the original position size which pretty much covered the stop should I have been spiked out from volatility. Of course its always the way that the position that gets scaled or closed out goes in your favour and then when you hold you get stopped but Im actually fine with the way I played as I took the conservative approach and I believe this is the best way to play.

One other thing to note is also where price stopped and reversed or at least had a reaction. This is the line I had marked on my charts as the scale out level had I been playing full position size.

J

Friday 6 July 2012

Charts

EURUSD

This is the 1st trade I took this week. Which considering it was taken on a Thursday means I was sitting on my hands most of the week.

The main reason behind the trade and my thinking was I was expecting volatility from the min bid rate and ECB press conference. Please note Im not a fundamental trader or do I really pay attention to the fundies but I do know that these kind of news releases can cause a major reaction in the markets so given the right technical entry Im gonna participate in the move.

My technical reason for entry was the week is clearly down so the weekly candle is a bear candle combine that with the break of Wednesdays low to me all looked short so I played.

Ive scaled out 1/2 of the position and stops at break looking to play through NFP but if price happens to be within 50 pips of my stop before the release I will close out.

J

Wednesday 4 July 2012

Trading is all about exceptions

There are many lessons that need to be learnt to become a successful trader along with all skills but when it comes to lessons I believe as a discretionary trader you have to learn the exception to every rule and when it comes to trading it has many exceptions. Pretty much every rule I can think of will have an exception and this is why we must learn them and this can only come through time and experience. This is not really something that can be taught and from my experience, even if you are taught it you must live it for yourself to validate it and make it your own experience.

This is why analysis of every trade is CRUCIAL. What did you learn from that trade winner or loser. Winning trades have common elements as do losing so what are they? If you take a trade and lose find out why so it doesnt happen again. If you cant find a reason then look harder and dont only look at the charts remember trading is a psychological game so maybe check whats going on between your ears ;)

Then once you learn these document them and start creating your rules or your rules of exceptions. Unless you have a photographic memory I highly suggest keeping a pen and paper by your side and when you learn something new document it. I really wish I had done this from the 1st day I started trading. I can only imagine how many books would be filled by now..haha! Then of course make sure you review and implement these exceptions.

The main point is make mistakes or as I have heard people say "fail faster" as there is nothing wrong with making mistakes or failing if we learn something from it so we dont do it again. Think about it for a second if you are making mistakes and these are costing you money what should happen when you stop making the mistakes? This is also why in the early days practising on a demo or small account is probably a safe bet rather than blowing your account before you have the chance to even learn the rules of the game.

Monday 2 July 2012

How I trade

Seeing as its the start of the month and quarter Im gonna sit on my hands today and see how the market wants to play out for the coming month.

Ive decided to blog about how I trade. Im a discretionary price action trader. What you see on the pic above is pretty much what you get. Im not interested in indicators like bollinger bands, macd and moving averages. Dont get me wrong in my past I have used and played around with these indicators but for some reason I always come back to pure price. I like things to be clean and simple.

I do use things like trend lines, horizontal lines and sometimes fibo's.

When I say Im a price action trader it doesnt mean that I look for pin bars or candle formations though they can sometimes support my idea but rather I mark key areas where I expect buyers or sellers to come back into play. I generally always try to think continuation as it suits my personality better as I rather be right more often and take trades with good risk vs reward but this also means taking less trades which is what Im still learning to master and thats where I also think this blog will come in handy.

As WMD always says if price is going up it can go higher and if its going down it can go lower and when its going up think "where can I buy" and when going down think "where can I sell". I really think this way of thinking can keep you out of a lot of trouble and generally keep you on the right side of the move. I know when I changed my way of thinking to looking for continuation more often it had an immediate impact on my trading. I didnt realise how often I was actually fighting price and trying to pick tops and bottoms. I have never ever heard anyone say picking tops and bottoms is a profitable way to trade. Dont get me wrong most people including myself love to do it but in the long run I think you get yourself in more trouble than its worth and that because you are always on the wrong side of the move trying to play counter trend.

If your interested in learning how to trade price action there really is only one place and that at http://www.wmd4x.com/ and you can also get some great info from http://www.forexfactory.com/showthread.php?t=206723

J

Saturday 30 June 2012

Charts

GBPJPY

This was a trade I just closed out for + 50 pips. I took no where near what I should have out of it but considering I risked 15 pips to initiate the trade it wasnt bad risk to reward. I personally would have held at least part of the position but seeing as it was end of week/month/quarter I decided to close out any positions I had running.

What I really like about this setup is the amount of confluence meeting at one point. I actually didnt think I was going to trade yesterday but when I see this amount of confluence at 1 point how can I resist.

The other factor going with it is Im trading with the current momentum looking for a continuation.

Have a good weekend all!

Wednesday 27 June 2012

Funny Stuff

This song is a classic! I cant believe the music video though. Had me nearly in tears!!!!

Charts

EURUSD

So Im kinda getting interested in trading EUR up to the 1.27 area. She is finding support around the 1.2450 zone as marked by the box. Lots of wick in that zone and Im sure pinbar traders will be going nuts.

1 reason Im a little cautious at the moment is all those wicks make it and easy zone to target before heading up if she is gonna head up at all. Please dont make any mistake theres nothing I want more that to sell the EUR down to parity (haha) but at the end of the day Im a techincal trader and thats how Im reading the charts but as marked on the charts if she breaks through my support zone I will be hunting shorts.

Monday 25 June 2012

Welcome!

Hello and welcome to my blog. My name is Jay and I trade the FX market.

I plan on using this blog for something fun to do and post things Im currently looking at mainly in the market but hey if theres something funny or on my mind who knows.

Please be aware that if I post anything trading related it is not to be taken as a trade recommendation or any kind of advice. Im purely doing this for me and if you do enjoy or get something positive out of it thats great!

Subscribe to:

Posts (Atom)